when are property taxes due in williamson county illinois

Last day to pay with personal check. Along with collections property taxation takes in two additional general functions.

Chicagoland Il Area Counties 2020 2nd Installment Property Tax Due Dates Chicagoland Mchenry Property Tax

Last day to pay with credit card.

. WCIA The private owner of the former Champaign County Nursing Home hasnt paid a cent toward property tax bills on the facility this year. That updated value is then taken times a combined levy from all taxing entities together to calculate tax due. May 28 Mail Tax Bills.

The Williamson Central Appraisal District is a separate local agency and is not part of Williamson County Government or the Williamson County Tax Assessors Office. Mail received after the. Williamson County collects on average 138 of a propertys.

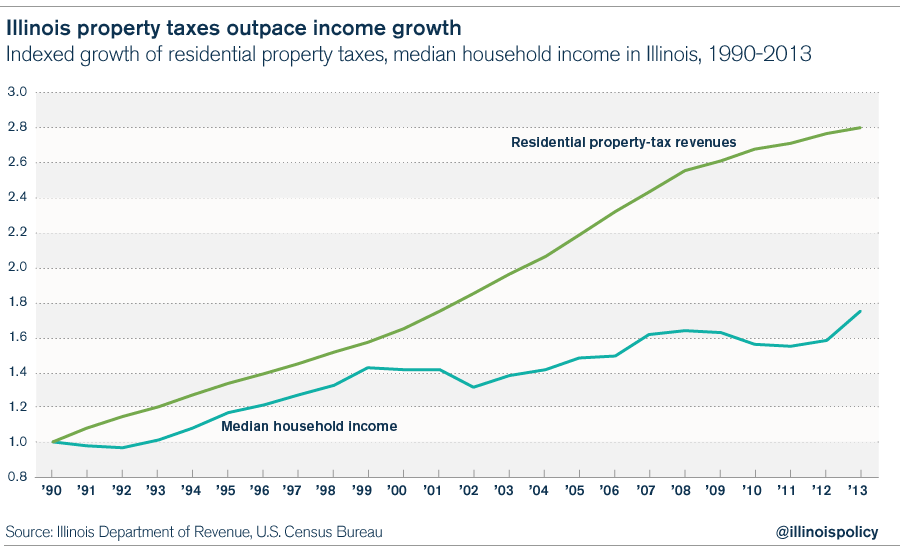

Welcome to Williamson County Illinois. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Establishing property tax rates and carrying out appraisals.

2022 Williamson County property taxes are due by February 28 2023. May 3 Co Clerk Extends Taxes. 173 of home value.

10 hours agoURBANA Ill. According to Williamson County Treasurer Ashley Gott this years due dates are Aug. Counties and Williamson in addition to.

You will be assessed a penalty at 1 ½ per month. 2018 - 2019 Real Estate Tax Collection Schedule. Those entities include your city Williamson County districts and special.

If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on. Tax amount varies by county. After September 25th a 10 fee PER PARCEL will be added in addition to the 1 12 per month late fee.

The median property tax in Williamson County Illinois is 1213 per year for a home worth the median value of 87600. March 7 Sent off final abstract. The median property tax also known as real estate tax in Williamson County is based on a median home value of and a median effective property tax rate of 138.

July 11 1st Installment Due. In most counties property taxes are paid in two installments usually June 1 and September 1. Cook County WLS -- The second installment of Cook County property taxes are usually due by August but those bills have not even been sent out to taxpayers yet.

A USPS postmark date of 22823 will be accepted as proof of timely payment. Property tax is calculated by multiplying the propertys assessed value by the total tax rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would. The treasurers office will begin accepting payments on Monday July 26.

July 12 Sept.

Williamson County Il Property Tax Search And Records Propertyshark

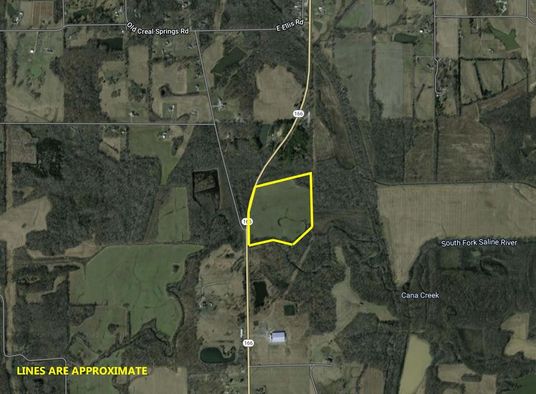

Online Auction Postponed Williamson Johnson Co Il 1873 Ac Wooded Creek Bottom 2804a Buy A Farm Land And Auction Company

Williamson County Il Land For Sale 24 Vacant Lots

Community Profiles Williamson Inc

Online Auction Williamson County Il 523 Acres Hunting Deer Turkey Waterfowl Lakes Ponds 2778a Buy A Farm Land And Auction Company

Home Is Where The Hurt Is How Property Taxes Are Crushing Illinois Middle Class

Library Williamson County Illinois Historical Society

Freeman Spur Illinois Il 62841 62896 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

2021 Williamson County Final Multiplier Announced

Williamson County Illinois Chain Of Title And Act Of Creation Williamson County Illinois Historical Society

Williamson County Illinois Genealogy Familysearch

Williamson County Homeowners 65 Plus And Disabled To See Property Tax Relief Community Impact

Property Tax Rates Williamson County Tn Official Site

Cheap Houses For Sale In Williamson County Il Point2

Land For Sale Property For Sale In Creal Springs Illinois Land Com

Cheap Houses For Sale In Williamson County Il Point2

Residents Of Lake County Pay Highest Average Property Taxes In Illinois Illinois Thecentersquare Com